Chances are you’ve just returned from NBAA 2016; hope your company’s investment of time, money and other resources paid off (or will pay off) for you.

And, chances are, you’re going to be taking a hard look at and finalizing your 2017 marketing, sales and advertising programs and budgets. Here, briefly, are three things you should do as part of that process:

First, understand your brand position, and act accordingly:

There are only three kinds of brands; which are you?

- Leaders – top brand in the category, leader in sales, market share, revenue, profits, reputation, awareness; examples are Gulfstream (large jets), Cessna (small jets), Signature (FBO)

- Challengers – the one, two or maybe three brands that go head to head with the respective Leader; must have “want to” (energy, aggressiveness), “the will” (commitment of $ and other resources) and “the goods” (products/services with measureable improvement in quality, value, innovation). Examples are Embraer, Garmin, Pilatus

- “Other” brands – certainly not a Leader, and lacks the ambition, energy, commitment of resources, and product innovation to compete as a true Challenger, BUT can still have a good business with strong products, customer service, or a profitable niche specialty; examples are Piper, Avidyne, TAC Air

Once you realize/accept the kind of brand you are, act like it!

- Leaders have the ability – and privilege – to speak with authority and confidence in defining what’s important in the category, they set the rules for debate (says things a Challenger can’t); Leaders will constantly seek to spend the necessary resources, and find ways to innovate, to stay at #1

- Challengers must carry their ambition, energy and aggressiveness over to selling activities; must use their product/service innovation to define a new set of category rules, to shift the debate to a new playing field (this is how you get around the Leader); and must be more aggressive in both message and ad spend to rise above the Leader’s authority

- Others – key question is what is your long-term goal? Maintain a slow growth yet consistently profitable mode – then go with incremental product improvement and great customer service; understand if you’re a quality brand or a price brand, and communicate value through either avenue; or milk the company/brand until its value as a cash cow comes to an end?

Second, you must get a solid handle on business aviation media in a digital world:

Fifteen years ago pretty much all you needed was print ads in key trade books, high quality collateral to give to your sales guys to mail out and take to customers and trade shows, a good PR program, and a steady participation in the aforementioned trade shows.

Now, B/CA magazine is half the pages it used to be, collateral is downloaded from your web site, and PR has now exploded with social media, live feeds, demos, webinars, news alerts. Trade shows are still very important, in fact they seem to never stop proliferating.

Key focus for 2017: where does your company stand on digital communications?

- First and foremost, you must have a good web site

- Social Media is a must and growing

- 77% of Fortune 500 companies are active on Twitter (70% Facebook, 69% YouTube)

- How do you select the right media?

- Know your audience, e.g. 70% of CEOs on social only use LinkedIn (Microsoft)

- Think Mobile – 75% of internet use will be on mobile devices in 2017 (Zenith’s Mobile Advertising Forecast)

- Paid Promotions – Should I buy ads on social media?

- Organic growth of social media visitors grew just 0.1% in the past three and a half years (Adobe Digital Insights).

- Result: 38% of marketers (retail and B-to-B) use paid promotions now. Another 42% plan to add it in 2017 (Gartner Group)

- Measureable

- Metrics are readily available for social media, website visits, etc.

- You can and should check your competitors and their usage

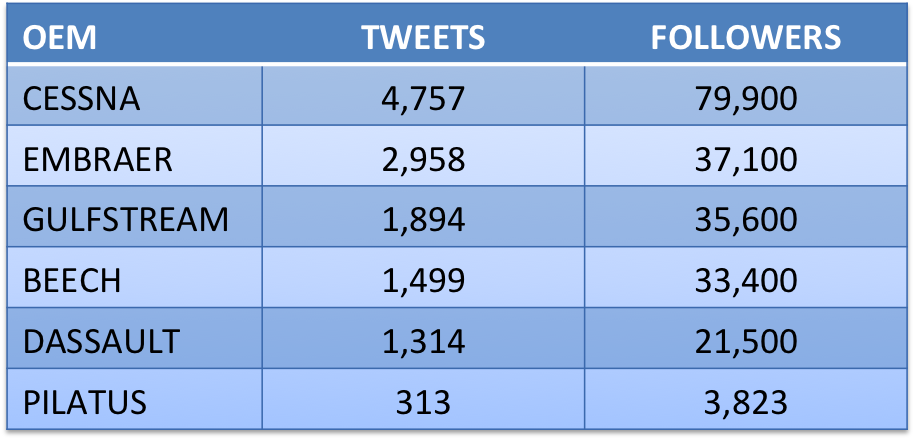

Let’s use the last point as an example: what are your competitors doing with social media? We took a look at some of the major airframe OEMs’ Twitter use.

We can see that Cessna has been most aggressive at developing a following:

While quality of Tweets is not measurable here, certainly there is something to be said for having a frequent stream of Tweets in building an audience — and this is just Twitter. There are many other channels to explore. We discovered a number of other interesting results from our Twitter analysis that we’d be happy to share with you. Just contact us by email or telephone and we can discuss.

Have you done any similar analysis to see where you stand versus your competitors?

Third, if you don’t currently have a comprehensive measurement program in place, do it now, ideally before your CEO asks

You must be able to show what’s working in your marketing and sales programs, and your media efforts, and know what is not working so you can fix it effectively. With both the digital and Big Data ages upon us you must get in front of this.

Now, be aware that there are two kinds of marketing measures:

- “Counting” measures, which are “how much?” How much did we sell last quarter, how much money did we make, how much profit, how much stuff do we still have in the warehouse to sell? Counting measures also include:

- Lifetime customer value assessment

- ROI on promotion spend

- Feature/price analysis for new products

- “Conversion” rates for online communications (click rates, tech sheet download rates, etc.)

- “Thinking” measures: what do our customers think of us; what do they think of our competition? What do they think of our product quality? What is our brand awareness, and reputation? These measures include:

- Net promoter score (“Would you recommend us . . .?”)

- Conversion scores (awareness, to consideration, to favorite)

- Product differentiation scoring

So there are many tools in the measurement toolbox, and you should be looking at:

- Program and product specific ROI

- Effectiveness of specific channels (web site, Twitter, LinkedIn, etc.)

- Counting and Thinking measures for both you and key competitors (Counting measures are not hard to do. Thinking measures are harder to do, but do them you must)

- With the shifting of communications online, the scope of Counting measures has increased greatly

- Test everything! (e.g. A/B testing)

- Whatever is unique and critical in your situation

Recap, for 2017:

Make sure you know what kind of brand you have, and are planning and acting in sync.

Digital communications and media aren’t going away; make sure you have a plan to at least evaluate whether and how much of it is right for your competitive circumstances. You may decide not to go there, but you’ll be acting out of considered judgment and not by default.

Put a measurement plan in place that will 1) measure what is important in your company and 2) deal with the ever-growing amount of data out there.

Mark Ryan

November 7, 2016

Dallas, TX