Rightly or wrongly, the business aviation industry seems to view annual deliveries as the benchmark for industry health. When deliveries are higher year-over-year everyone feels optimistic and when deliveries are lower, the feeling is less than enthusiastic. And so it was in late February, when GAMA announced 2016 results for business jet deliveries, the word of the day was “disappointing.”

After all, “only” 654 business jet units were delivered (excludes the 7 airliner VVIP aircraft). That’s not exactly a number to fuel recovery hopes for a struggling industry and was below many industry forecasts which themselves had been repeatedly adjusted downward during the year.

Were expectations too high?

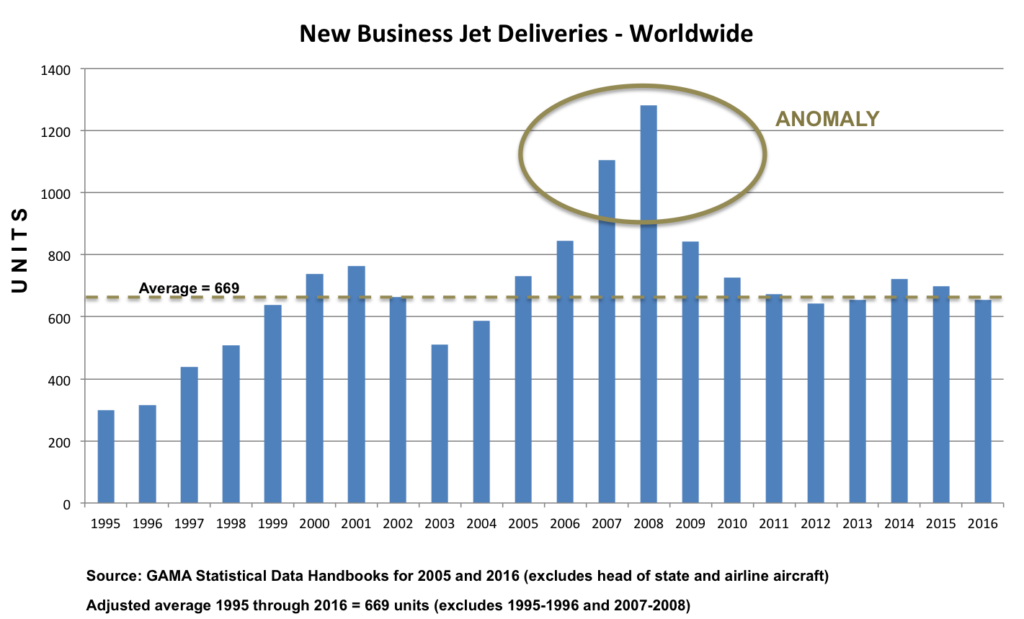

Well, if you believe jet deliveries in 2007 and 2008 are the norm, then yes your expectations are too high and you should be disappointed. If we look, however, at industry deliveries since 1995 (chart below), we can see some revealing data.

Calculating the average for the 22-year period 1995-2016 results in 684 deliveries – a little higher than our 2016 actual number. But looking at the chart there are some obvious outliers in the mix: 2007 and 2008 are clearly outside the norm. So let’s call these two years an “anomaly” and remove them for the moment; and to be conservative let’s remove the two low delivery years of 1995-1996. We now have average deliveries per year of 669.

Using this admittedly simple analysis, we can perhaps call 2016 a “little disappointing” but not really far off what we should expect in an average year. So, what’s really going on here to justify any disappointment?

What the delivery numbers don’t tell us is there appears to be an underlying weakness in the market.

Everyone in the industry should by now be aware of the tremendous overhang of used business jets accumulated during the Great Recession. Roll forward eight years to today and the higher volume of that inventory largely remains (about 40% more units for sale than pre-Recession). This inventory has created unprecedented downward pressure on pricing – not just for used jets but new jets as well.

Based on the talk we hear from industry insiders, the pricing pressure and resultant pricing gap between new and used jets has led to deep discounting of new aircraft in order to compete for sales. The obvious implication for OEMs is that production volumes remain too high. The not so obvious implication is that discounting creates a recipe for future disappointment, i.e. today’s deeply discounted new jet becomes tomorrow’s (as in five years) trade-in dilemma.

This challenge is not going to be solved by the introduction of new jet models with marginally incremental improvements in fuel economy and higher resolution cockpit displays; nor by the demand from emerging markets such as China.

The issue goes deeper and calls for some hard analysis of the number of aircraft being built and the number of models being offered.

At least one OEM president and CEO, Paulo Cesar de Souza e Silva at Embraer, has publicly acknowledged the situation*: “We have taken the decision to be more disciplined in terms of the number of aircraft we are going to manufacture and deliver to make sure we will not operate under losses… Growth is good, however there are certain moments during which we cannot fight against the market.”

No doubt airframe OEMs are caught in a quandary. Building business jets is not an industry that can turn on a dime. Long development periods, tooling up for production, complex supply chains and training skilled workers is a long-term proposition that lags market changes. But if the Great Recession taught us anything, it should be that the landscape of the business jet market has changed: many flight departments have disappeared, fleet management companies are growing more powerful, user demographics are evolving with generational changes, technology is a greater competitor.

OEMs need to research, understand and embrace the changes and adapt accordingly. Otherwise, when future annual delivery numbers are announced we’ll be hearing the word “disappointing” for many years to come.

(For a deeper discussion of this and other topics affecting business aviation, you can reference our BlueSky Blog and our business aviation marketing eBook at wrg-avation.com.)

Chris Pratt

Dallas, Texas

March 9, 2017

* Aviation Week & Space Technology, January 9, 2017 article, Joe Anselmo, Embraer Hits ‘Pause’ on Bizjet Ambitions