As promised in our February post on sales prospects for 2018, we want to check on the progress of the business aviation industry and what that might mean for the future. With a booming U.S. economy and a global economy in recovery, we suggested that 2018 should be a good year for sales. So let’s take a look.

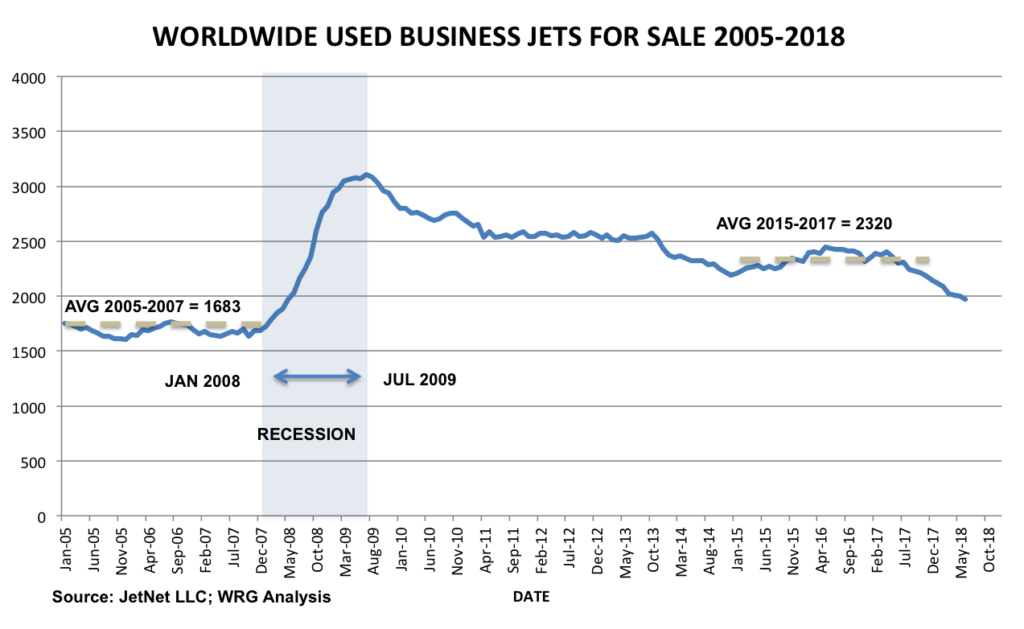

Indeed, the first six months of the year have been good – especially in the used business jet segment. That segment, as always, is a leading indicator of market health and is the key to future sales new or used. The first half of 2018 witnessed an 8% reduction in used business jet inventories, down from 2,147 in December 2017 to 1,972 In June, 2018 – the first time in a decade (i.e., since the start of the Great Recession) the inventory number has been below 2,000 units.

Available used business jets now represent 9% of the active fleet. This is to the low side of historical average. When used jet inventory gets down to or below its historical average it not only indicates there is healthy demand but also indicates a scarcity of young, good quality used inventory. In these conditions buyers increasingly consider new aircraft as well.

So, while new business jet deliveries for most of the OEMs are flat for the first half of 2018, the order books are strengthening and beginning to show greater than 1:1 book-to-bill ratios. With several new jet models recently or about to be certificated, this is a strong sign for growth in new deliveries over the next few years. We won’t see the real impact of these orders until next year and the year after, but it appears to be coming.

And let’s not ignore turboprops. While the delivery of 260 in H1 is 9% above 2017’s first half total, all is not perfect in the segment. A few years ago, GAMA added agricultural turboprops to the delivery numbers and this can sometimes obfuscate results for the traditional non-ag turboprop market. You used to be able to rely on about 400 non-ag turboprops to be delivered each year. But in recent years this has lagged, mostly due to fewer Cessna Caravans in the mix. Where we usually expect about 100 Caravans per year, nowadays it’s more like 65-70. Hence the new Cessna twin-engine Skycourier and single engine Denali (both due out in a couple of years) should help supplant waning Caravan sales.

So, on balance, good news – what will the OEMs do with it? We know that industries, like humans, tend to have short memories when it comes to bad times, but we fervently hope the OEMs will retain the lessons learned from the Great Recession and keep a tight rein on production levels and model offerings. No one wants a repeat of the Great Recession and its devastating impact on the labor force, their families, and the future pool of skilled labor not to mention profitable operations.

Exciting times lie ahead provided the industry listens to its users. Let’s see how the rest of 2018 plays out.

Chris Pratt

WRG Aviation

August, 2018