(This is the first of a brief series of what we hope are helpful posts leading up to next month’s NBAA-BACE in Las Vegas.)

If it seems to you there’s an aviation trade show held nearly every week, you’re not far off. The National Business Aviation Association (NBAA) alone hosts 13 different trade events and conferences during any given year. Add to this specialty shows organized by market segment, operator type, aircraft model, plus regional events for state associations and trade groups – pretty soon you’re booked for the year.

Trade shows continue to proliferate for a number of reasons not the least of which is they are very profitable for show organizers. Add to that the fact that business aviation has become a global industry and competition for your product or service is more intense than ever.

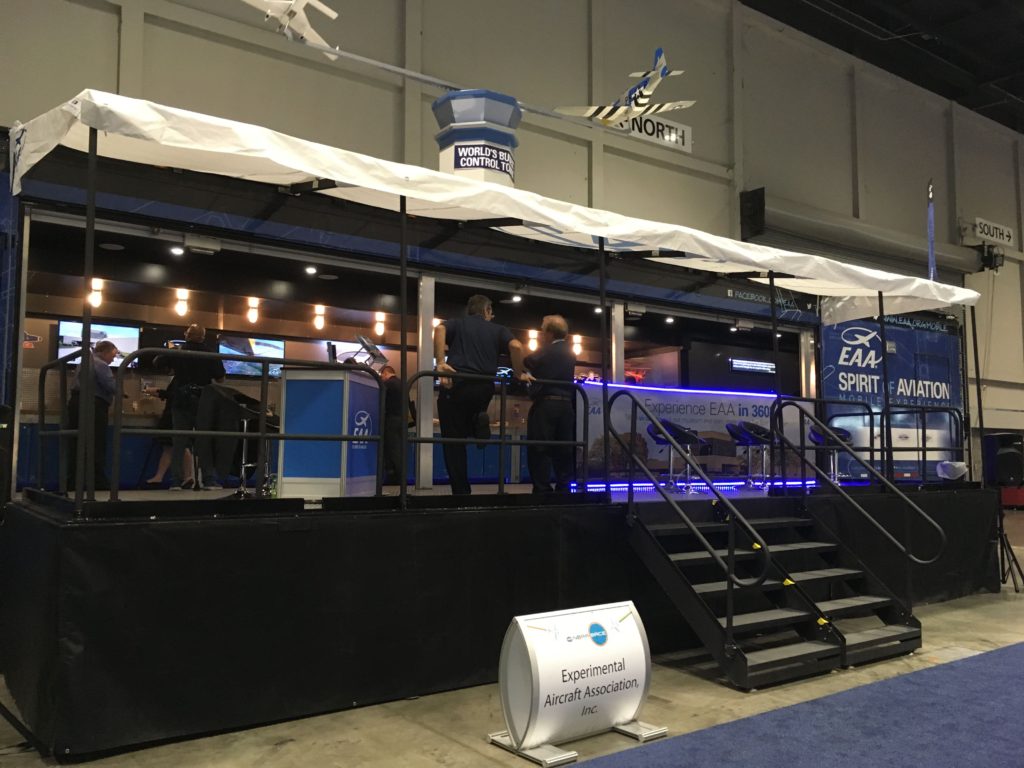

Perhaps the most important reason trade shows continue to proliferate is because they provide one of the few chances we have to be face-to-face with customers. In a digital age where communications is dominated by social media, email, web sites and texting, trade shows are a place where customers can be hands on with products, meet their support team, put a face to a voice they’ve only heard on the telephone, and actually say hello to the company president.

Yet trade shows remain controversial for management largely for the following reasons*:

- Unknown effectiveness

- Difficulty of measuring efficiency

- High and rising costs of participation

- A growing feeling that shows are boondoggles

if you have responsibility for trade shows at your company you have probably been confronted with statements from senior management such as:

“Trade shows are terribly expensive and of limited value for the business we do versus the dollars spent.

“Everything nowadays is done for the show management, not for the exhibitors.”

“The major reason we go to trade shows is because our competitors are there.”

If those remarks sound familiar, take heart. The quotes are from a Harvard Business Review* report on trade shows dated January 1983. Things haven’t changed much in 30+ years.

The marketing team needs to be prepared to counter these feelings of uncertainty with well-reasoned answers. Let’s start by looking at the following questions:

- Why exhibit at a trade show; what is your show objective

- How do you select the right show(s)

- How do you measure results (ROI)

- What critical tasks do I need to do before, during, after a show

Why exhibit at a trade show?

Companies exhibit at trade shows for a number of reasons. Primarily it is to meet customers and prospects, to generate leads, to compress numerous road trips into one, to spy on the competition, to promote a new product or service, to enhance brand image, to get coverage by the media.

Yes, you are there to sell, but with the long sales cycles typical in business aviation the sale is likely to occur sometime after the show and should appear on your post-show tracking.

For many companies, trade shows are their largest marketing expenditure. As such, events should be approached like any other marketing and sales tool: it is important that your trade show exhibit represents and extends your overall brand position for continuity with your other marketing efforts.

Secondarily, companies often exhibit at trade shows because their competitors do; there is a fear that not being at the show may create negative talk about the well-being of the company.

Selecting the right trade show(s)

First and foremost trade shows are an extension of your marketing and sales efforts and in many cases are the company’s key communications channel. Like any of your other marketing and sales programs, trade shows should meet a set of criteria if they are to be successful.

Who attends the show? It’s the basic question that needs to be asked. If your marketing target is not in attendance in sufficient numbers, then why go? You can analyze previous show data available from the organizer to determine how many/what percentage of attendees at the show are people you actually want to talk to, and more important, can potentially buy your product or service. If the answer is a sufficiently high number of attendees, then exhibit there.

ROI—are you measuring the right thing?

Your CFO would love to see proof that the money you spent on the show was more than covered by the sales that were generated. Yet, business aviation trade shows are typically “non-selling” events; the long sales cycle prevalent in business aviation makes on-site sales unlikely (this is true for pretty much any industrial show). The items being sold are far too expensive for on the spot decisions to be made.

So if the show is a “non-selling” event, what needs to happen to make it a success? Effective trade show marketing includes regular contact with existing customers, key account servicing, learning about customers’ future plans, new product introductions, identifying the decision makers, prospecting, and creating brand awareness. Note that not all shows will have opportunities to meet all the above objectives, but each show should enable you to achieve most objectives. Otherwise, you’re at the wrong show.

You can measure items such as number of contacts made, number of meetings held, business cards scanned, entries into a drawing, etc. These are difficult to assign quality immediately but they can be tracked and analyzed. The data should be entered into your CRM system and tagged so that resultant sales at a later time can be tracked back to a trade show contact data point. Prior to the following year’s event, you can assign a CPM (Cost per Thousand) measure based on your last year’s cost and the value of any subsequent conversion into sales and also what the lifetime customer value means for your company.

Critical tasks to do before, during and after the trade show

Successful trade shows are the result of careful pre-show planning, execution and post-show follow up.

Pre-show you want to ensure that the design of the exhibit utilizes messaging that reflects the current brand positioning; that clear objectives for the show are set and communicated to the sales and management team attending; that senior management buys in to the plan; that attendees are notified of your exhibit location and given a reason to come see you (perhaps tease them about any new announcements or special show promotions); and the media is contacted with your news plans and any photo ops that may be available.

During the show, keep track of visitors via counts, card scans, contests, etc. People are always moved by the word “Free” so have some good quality free stuff to hand out; highlight anything new in products or services.

Post-show be sure to share any scanned attendee lists with the sales team; feed the CRM system; follow up on show site requests; make notes on what aspects of the event/exhibit worked and what didn’t (these will come in handy for the next event); summarize the final show budget to make the following year’s budgeting easier.

It may be difficult to quantify everything about a trade show. By applying good management practices to a predetermined measurement criteria and keeping focused on your company’s show objectives you will greatly enhance your ability to answer the question “what’s my ROI?” and demonstrate the value of trade shows in the marketing mix.

* “Get More Out of Your Trade Shows” by Thomas V. Bonoma, Harvard Business Review, January, 1983